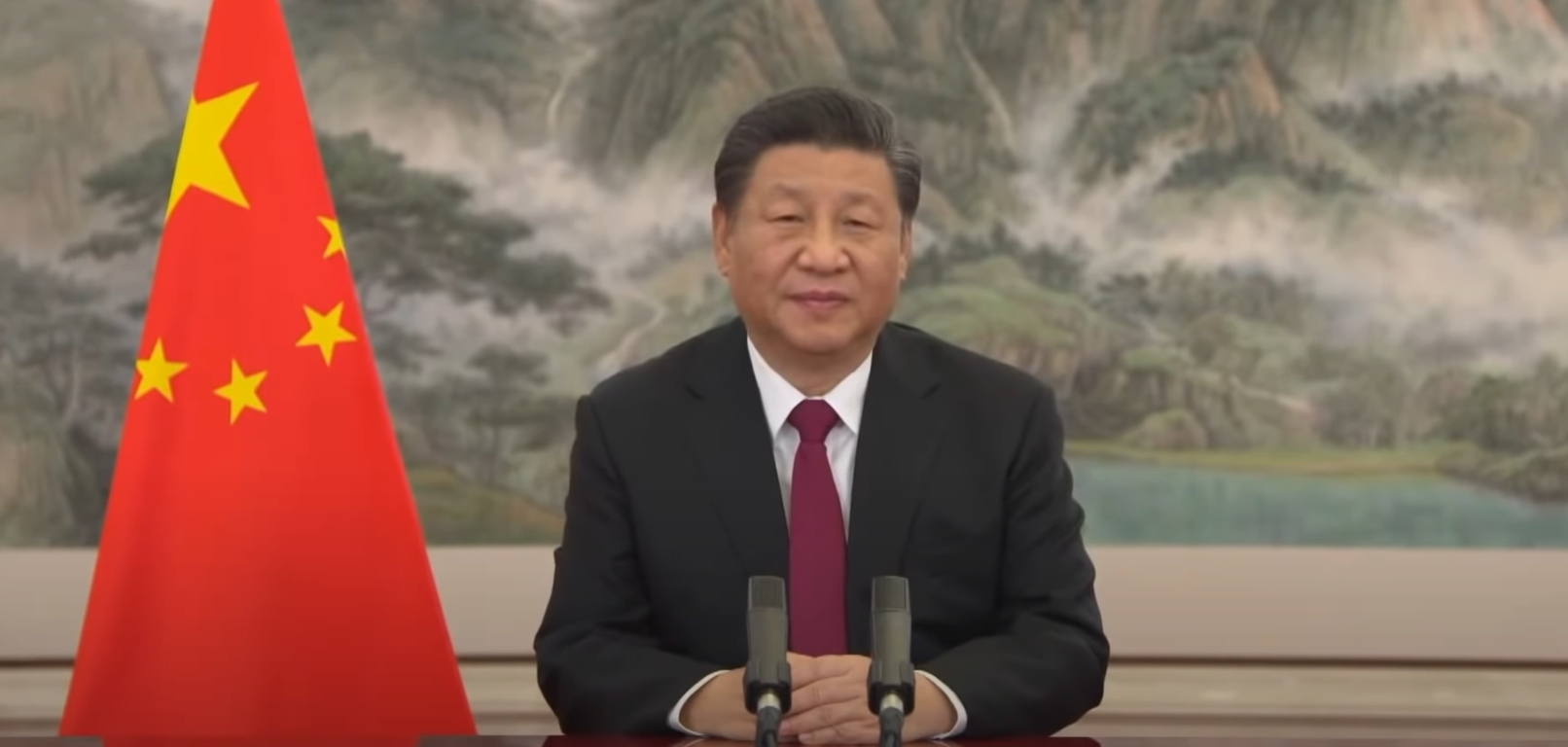

At the 2021 meeting, President Xi announced he will be pushing for common prosperity - raising the incomes of low-income groups, promoting fairness, making regional development more balanced, and stressing people-centered growth. President Xi pledged to “reasonably regulate excessively high incomes, and encourage high-income people and enterprises to return more to society.”

Common prosperity

Common prosperity refers to the goal of achieving a more equitable distribution of wealth and ensuring that the benefits of China's economic development are shared by a wider segment of the population. While China has experienced significant economic growth that lifted hundreds of millions of people out of poverty over the past few decades, income inequality has also increased greatly, leading to concerns about rising social unrest among a population of more than 1.4 billion spread over a sprawling land area covering five time zones and bordering 14 countries by land - the most of any country in the world.

To address these social concerns, the Chinese government has outlined a series of measures aimed at promoting common prosperity. These measures include:

- Wealth redistribution: policies to redistribute wealth by imposing higher taxes on the wealthy & high-income individuals to regulate excessive income in certain sectors as well as supporting social welfare programs.

- Poverty alleviation: China has made significant progress in poverty reduction, and continues to focus on eliminating absolute poverty. Efforts include targeted poverty alleviation programs, investment in rural areas, and improving access to education, healthcare, and basic infrastructure.

- Rural revitalization: Xi's government aims to bridge the urban-rural wealth gap by promoting rural development, improving agricultural productivity, and providing support for rural industries and infrastructure with initiatives to modernize agriculture, increase rural incomes, and improve living conditions in rural areas.

- Social welfare reforms: Reforms to the healthcare system, pension system, and social insurance programs to provide better access to essential services and protect individuals and families from financial risks as the China government works to expand its social safety net.

- Regulation of wealth accumulation: Measures to curb excessive wealth accumulation and address monopolistic practices will be introduced by the Chinese government, e.g. increased scrutiny of large corporations and technology companies, antitrust regulations, and measures to protect the rights and interests of workers.

To counter widening socioeconomic inequality in China, the Chinese government is also putting its focus to its “security” drive in addition to its “common prosperity” drive by pushing for the “dual circulation” strategy to the party constitution with the aim of narrowing socioeconomic inequality as protests against the rich and powerful mount at home.

China's dual circulation strategy, aka "dual circulation development pattern", introduced in 2020 seeks to strike a balance between domestic and international factors, with greater emphasis on domestic drivers of growth with the ultimate aim to rebalance China's economy and promote sustainable long-term growth by focusing on two main components: domestic circulation and international circulation.

- Domestic circulation: This strategy seeks to boost domestic demand, stimulate consumer spending, and reduce reliance on exports and external demand as the primary drivers of economic growth. It emphasizes developing a strong domestic industrial base, improving infrastructure, promoting urbanization, and fostering innovation to drive consumption-led growth.

- International circulation: China aims to optimize its international economic relationships, enhance its competitiveness, and pursue mutually beneficial trade and investment opportunities while safeguarding its national interests. This strategic component focus on external markets and engagement with the global economy by expanding foreign trade, attracting foreign investment, and enhancing China's integration into global value chains.

China understands the importance of external markets while emphasizing the need for self-reliance. China is not decoupling from the global economy but is bracing itself against global headwinds gaining strength in Europe and America by pursuing “high-quality development” in terms of technological advancements and domestic innovation to ensure long-term economic resilience and stability that will impress the western countries.

President Xi is prepared to sacrifice China's economic growth to realise his target of gradually achieving common prosperity for the general population. In fact, the concept of common prosperity is already deeply etched in the Chinese Communist Party's ideology, which emphasized the pursuit of social equality and the welfare of the people. Wealthy families in mainland China are very wary of President Xi's common prosperity drive and are worried that income and wealth taxes may rise to extremely high levels in China. Many have already started or planning to shift their wealth overseas or relocating to other countries in order to preserve their immense wealth.

"With the Covid situation under control in mainland China and economic growth stabilizing after the gradual relaxation of strict Covid lockdowns, I believe President Xi may find it a suitable time to push ahead with his common prosperity drive this year." said Kiwi Lim.

One of the properties is a four-bedroom, 2,691 sqft unit at New Futura, a freehold condo along Leonie Hill Road in District 9 for $12.5 million or $4,645 psf setting a new psf-price high for the 124-unit by developer City Developments Ltd. The other was also another freehold luxury condo - a 7,718 sqft six-bedroom townhouse unit at Yong An Park on River Valley Road sold for $14.08 million or $1,824 psf.

The number of wealthy families from mainland China setting up family offices here in Singapore have been growing and may have exceeded 1,000 family offices by mid of this year as they shift their funds out of Xi's reach in his common prosperity drive, due to increasing global uncertainty, geopolitical risks and Singapore's reputation as a safe haven for wealth and attractive tax incentives even after the MAS set stricter criteria for assets under management, local investments and business spending for family offices to qualify for tax incentives last year.

"Many wealthy families plan to relocate out of China and the recent property cooling measure in Singapore where the ABSD for foreigners buying residential real estate in Singapore was increased from 30% to 60% may have little impact on their plans to move to Singapore." explained Kiwi Lim.

RSS Feed

RSS Feed