Analysts say the unsold stock of residential property is not all that high by historical standards. Unsold residential stock has fallen by more than half, from more than 44,000 units in 2008 to 17,421 units as at 3Q2017 according to statistics from URA.

Unsold inventory levels of 17,000 units are near 18-year lows, and we agree they could rise as more units — 20,000 by MAS estimates — are launched in the next one to two years. Analysts felt the pace of increase will be partially offset by home purchases, which are tracking at 12,000 units in the past 12 months.

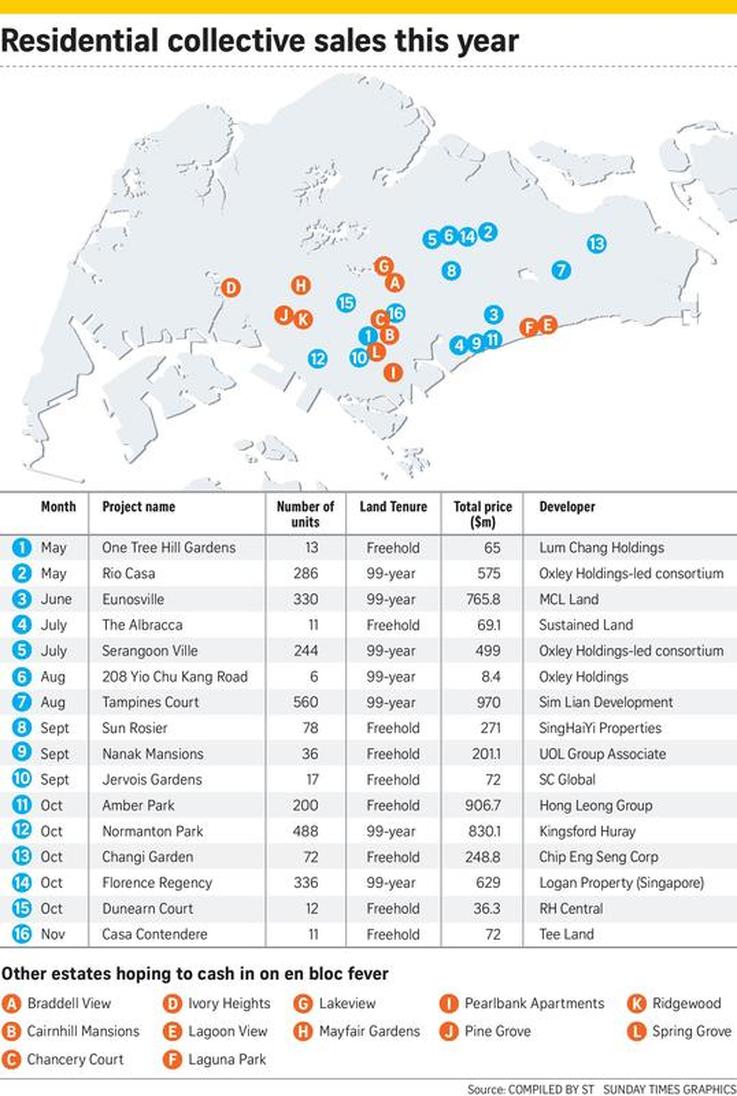

Some market watchers suggest that developers have chosen to replenish their landbanks by aggressively bidding for en bloc sites because there has been a reduction in the number of sites released under the Government Land Sales programme in recent years.

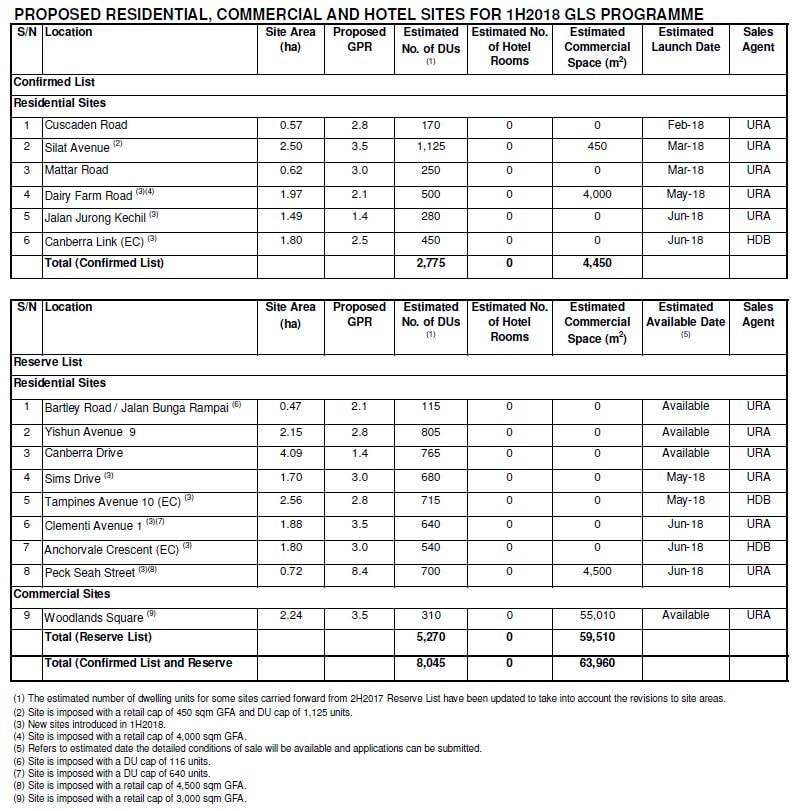

On Nov 30, URA announced the launch of four sites for sale. Two sites, on Holland Road and Handy Road, were launched for sale under the Confirmed List. Another two sites, on Mattar Road and Canberra Drive, were made available for application under the Reserve List. Together, these four sites can yield about 1,720 residential units, URA said.

The surge in land prices was not just the result of developers needing to replenish their landbanks but also the big stock market rally as the stock market in Singapore and regionally have done well in 2017. At the end of the day, demand and supply will dictate market forces will balance the property market.

RSS Feed

RSS Feed