Minister for Finance, Singapore

20 February 2017

Below are six measures that are likely to affect Singaporeans directly:

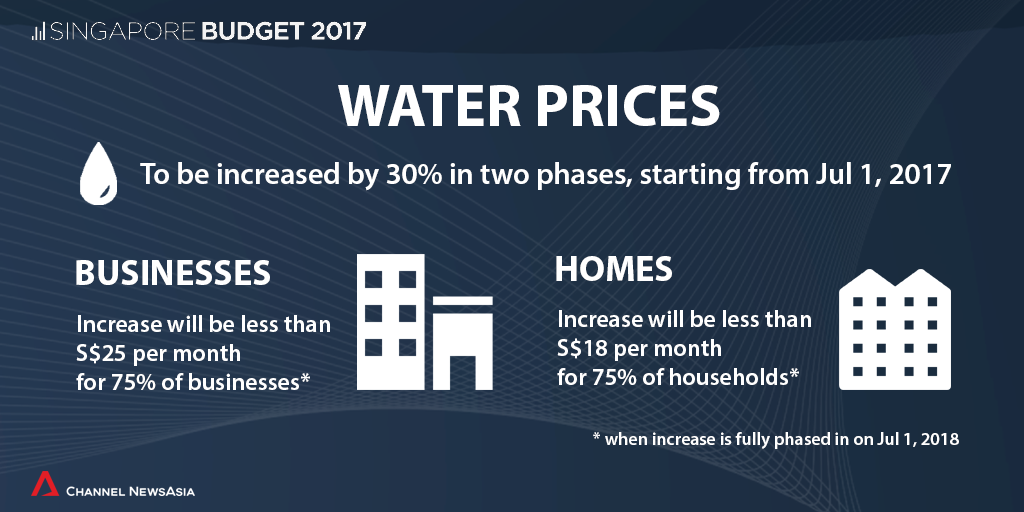

Prices of water need to reflect the rising costs of producing water. The Government's efforts in building more desalination and NEWater plants have also made water more costly. However, the Government will introduce measures to help lower and middle-class income households offset this increase. This is the first time in 17 years that water prices have been revised.

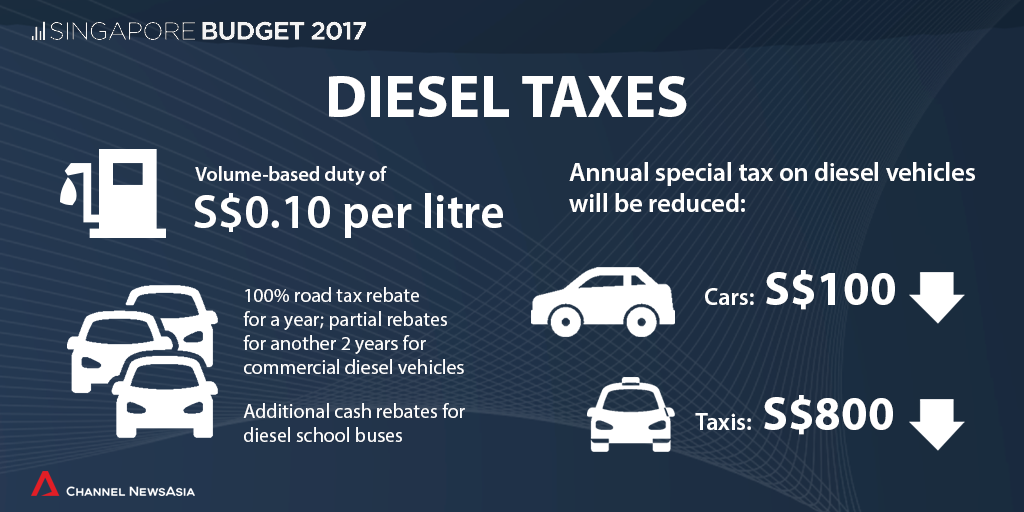

The Government is introducing a volume-based duty at S$0.10 per litre on automotive diesel, industry diesel and diesel components in biodiesel.

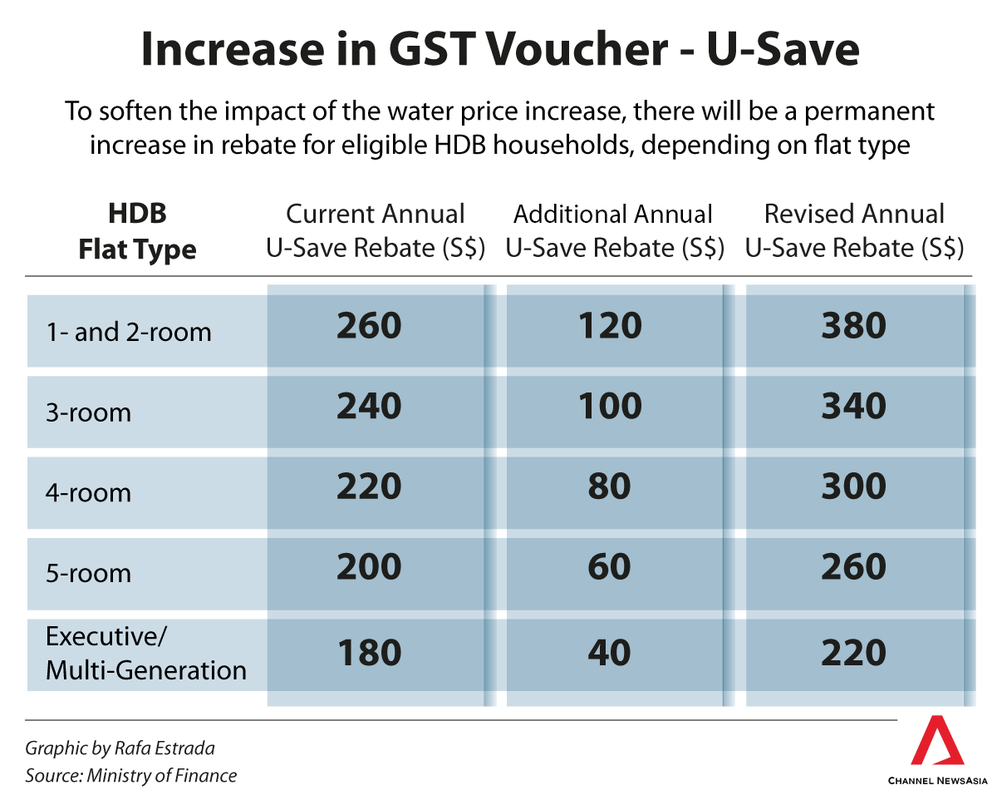

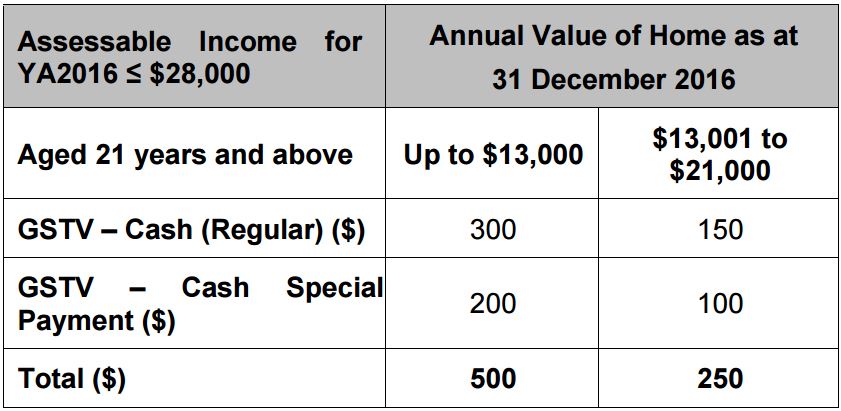

To offset the increase in water prices, there will be a permanent increase in the GST Voucher - Utilities-Save (U-Save) rebate for eligible HDB households. The increases will range from $40 to $120 depending on the HDB flat type. Lower-income households will also receive a one-off GST Voucher - Cash Special Payment of up to $200.

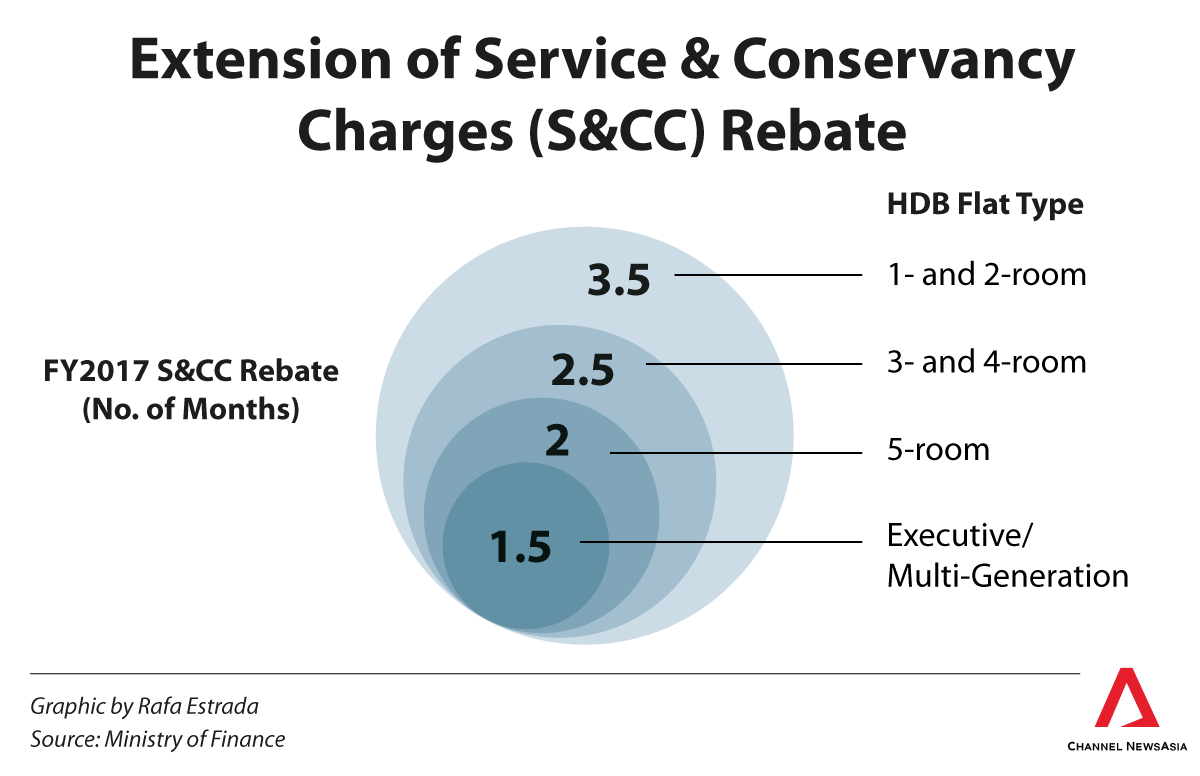

Eligible households will get 1.5 to 3.5 months of S&CC rebates this year.

To help residents with tax bills, there will be a Personal Income Tax Rebate of 20 per cent of tax payable, capped at $500, for income earned in 2016. - See more at: http://news.asiaone.com/news/singapore/budget-2017-5-things-may-affect-you-directly#sthash.jsX4ahPi.dpuf

Annual bursaries will rise up to $400 more for undergraduates, up to $350 for diploma students and up to $200 for students in the Institute of Technical Education (ITE).

Other than increasing bursary amounts, the income eligibility criteria will also be revised, enabling about 12,000 more Singaporean students to benefit and bringing the total number of beneficiaries to 71,000.

Couples who are buying a resale flat for their first HDB home will receive more subsidies from the Government. First-timer couples who buy resale flats that are 4-room or smaller will get $50,000, up from the current $30,000. Those buying resale flats that are 5-room or larger will receive $40,000, also up from $30,000.

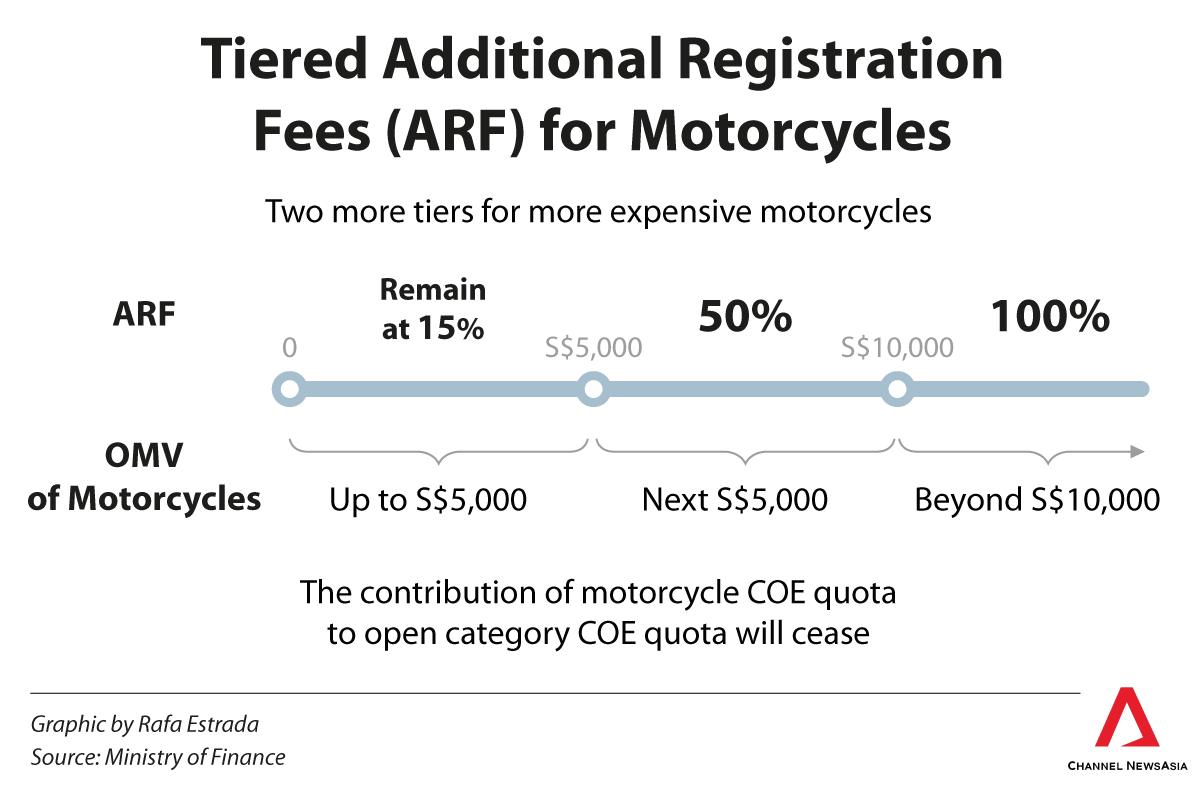

Motorcycle riders may soon need to pay higher taxes on their vehicles, following the introduction of a tiered Additional Registration Fee (ARF) system. At present, all motorcycles incur an ARF of 15 per cent of their open market value (OMV). But with the new system, the ARF for motorcycles with OMV of up to $5,000 will remain at 15 per cent, the next $5,000 will incur ARF of 50 per cent, while the remaining value over $10,000 will be subject to an ARF rate of 100 per cent. The tiered ARF will apply to motorcycles registered from the second certificate of entitlement (COE) bidding exercise in Feb 2017.

The Transport Ministry will also stop the contribution of motorcycle COE quota to the open category, as very few have been used to register motorcycles.

RSS Feed

RSS Feed