However, the recent months saw a darker economic outlook with war in Ukraine and the worst inflation the world has ever seen due to Covid pandemic, climate change and the war all combined together. This invariably cast a slightly gloomier outlook on the property market in Singapore especially when home loan interest rates in Singapore soar past 4.25% by the end of 2022 from only less than 1% in January as the Federal Reserve applied brakes on the hot inflationary economy by rising interest rates at an amazing rate never seen before.

The Singapore government also applied brakes recently in Dec last year and Sept this year to cool the local property market which saw prices soaring 10.6% last year in 2021 and an estimated 9.3% this year in 2022. After an unprecedented two sets of cooling measures were rolled out in a spate of less than 9 months to encourage prudent borrowing and to cool the hot property market in Singapore, many prospective homebuyers are wondering if they should wait for a possible price correction especially when America is arguably in a technical recession and Europe enters a blistering cold winter - literally and economically.

By the second quarter of this year 2022, private home sales rebounded with a robust take-up of new project launches, such as Piccadilly Grand and Liv@MB in the Rest of Central Region (RCR), the market roared back into action leading to an acceleration of home prices in Q2 2022 where we see mass market new launches in the Outside Central Region (OCR) not only challenging but pushing beyond the psychological barrier of $2,000 psf with the launches of AMO Residence in July, then Sky Eden@Bedok and subsequently Lentor Modern - all mass market condo projects in the Outside Central Region (OCR) with prices exceeding $2,400 psf were met with positive response from potential homebuyers.

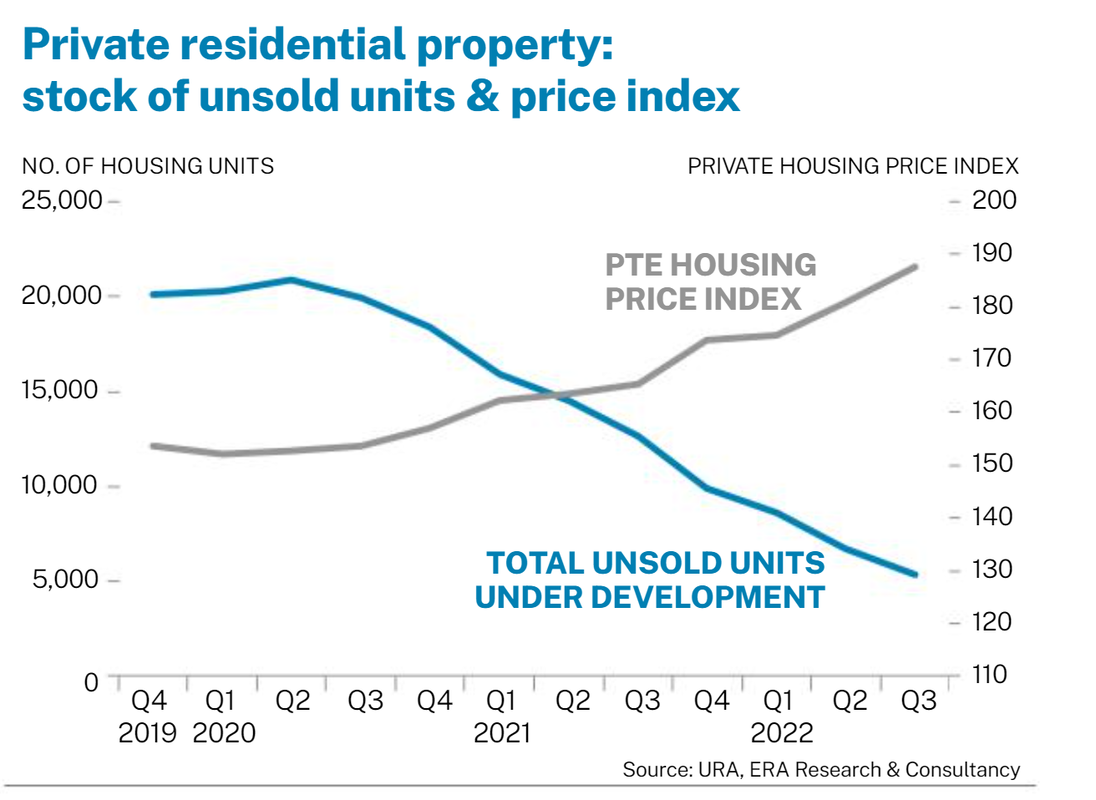

Based on information compiled by ERA Research and Consultancy with reference to URA data, the stock of unsold private residential property under construction (BUC) has been dropping for nine straight quarters to a fifteen year low of an estimated 5,320 units (excluding executive condo units) and is not expected to increase much next year according to the Business Times article on 12 Dec 2022.

The current level is the lowest since 3rd Quarter 2007 where unsold stock hits 4,666 units - during the property bull run of 2004 to 2008 when developers sold many private housing units. Looking back two years ago in 2nd quarter 2020 unsold private residential property under construction (BUC) was 20,919 units (excluding executive condo units).

Real estate professional Kiwi Lim believe that property prices may continue to rise next year in spite of the economic outlook with impending recession and war in Ukraine but the rise in prices is expected to be tapered downwards to around 2% to 3% in 2023 with an estimated 12,500 new private residential property under construction units (excluding executive condo units) expected to be launched next year with around 40 upcoming new apartment and condo private residential projects (excluding executive condo projects).

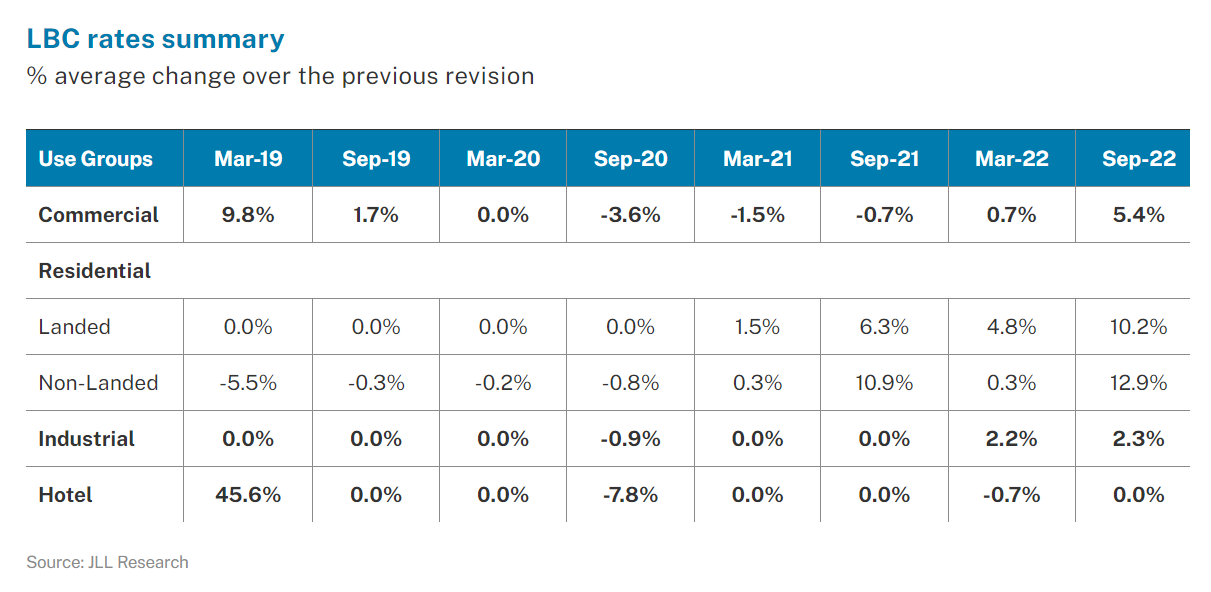

Property developers are unlikely to lower prices in spite of intensifying headwinds such as soaring interest rates and slowing economic growth due to high land acquisition prices and the recent announcement by SLA of the significant hikes in land betterment charge (LBC) rates for non-landed residential, landed residential, commercial and industrial use groups from the previous rates to reflect the generally robust performance of the local property market.

The biggest hike announced by SLA was for non-landed residential use, for which the LBC rates for the period Sep 23, 2022 to Feb 28, 2023, have been raised by an average of 12.9 per cent, compared with a 0.3 per cent increase during the previous revision that took effect on Mar 1, 2022. The latest rate hike was the sharpest since the 22.8 per cent spike in March 2018 which took developers by surprise as it will increase their costs for developing the land parcel.

"Sceneca Residence will be the first project to be launched in 2023 by a consortium led by developer MCC Land and is expected to be an important litmus test of market sentiment when the developer launch the project next month in January next year. Real estate market analysts and property developers will be closely watching this first launch of 2023 and I expect around 80% to be sold on the preview date due to its attractive pricing and ultra convenient location offering residents of Sceneca Residence an integrated lifestyle with a shopping mall and Tanah Merah MRT entrance at its doorstep." said Kiwi Lim from Huttons Asia

RSS Feed

RSS Feed